Federal Estate Tax Threshold 2024. Under the tax reform law,. What is federal estate tax?

The federal estate tax is essentially a tax on the transfer of wealth upon someone’s death. In 2024, the exemption amount for individual estates will reach $13.61 million, an increase from the $12.92 million benchmark in 2023.

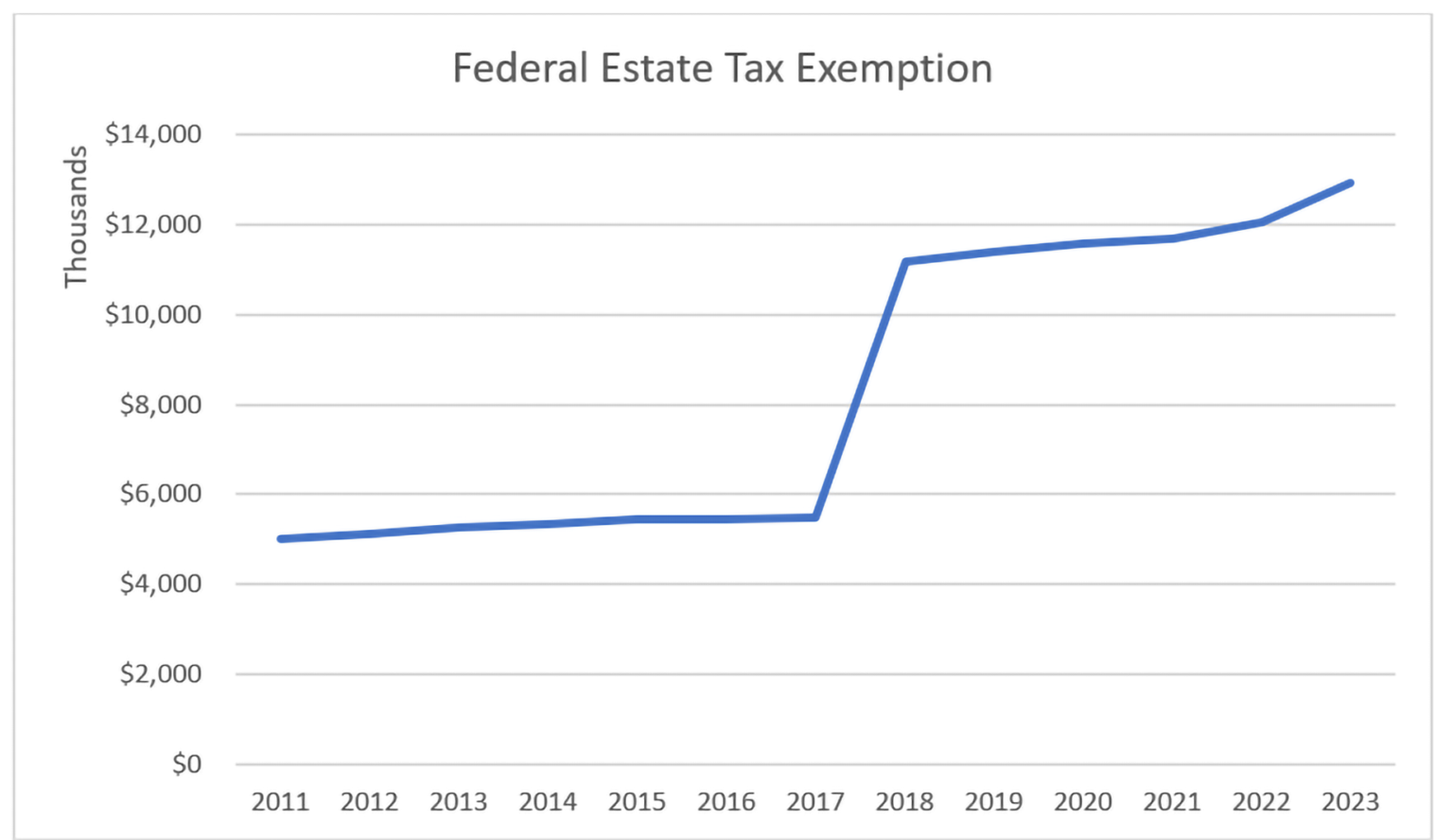

Because The Bea Is Adjusted Annually For Inflation, The 2018 Bea Is $11.18 Million, The 2019 Bea Is $11.4 Million And For 2020, The Bea Is $11.58 Million.

Affects large estates, with the 2024 exemption at $13,610,000.

For 2024, The Lifetime Estate And Gift Tax Exemption Will Be $13.61 Million (Or $27.22 Million For Married Couples).

Under the tax reform law,.

The Head Of Household Threshold Is $200,000.

Images References :

Source: asenaadvisors.com

Source: asenaadvisors.com

What is the U.S. Estate Tax Rate? Asena Advisors, Bc has proposed increasing the tax credit amounts, effective july 1. Federal judge rejects hunter biden’s bid to dismiss tax case in l.a.

Source: www.dandblaw.com

Source: www.dandblaw.com

Estimating Your Federal Estate Tax Law Offices of DuPont and Blumenstiel, Bc has proposed increasing the tax credit amounts, effective july 1. For people who pass away in 2024, the exemption amount is $13.61 million (up from the $12.92 million 2023 estate tax exemption amount).

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The federal estate tax is essentially a tax on the transfer of wealth upon someone’s death. Because the bea is adjusted annually for inflation, the 2018 bea is $11.18 million, the 2019 bea is $11.4 million and for 2020, the bea is $11.58 million.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, The federal estate tax exemption for 2024 stands at $13.61 million per individual. For 2023, this limit jumps to $12.92 million for.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, In 2024, the exemption amount for individual estates will reach $13.61 million, an increase from the $12.92 million benchmark in 2023. Bc has proposed increasing the tax credit amounts, effective july 1.

Source: mpmlaw.com

Source: mpmlaw.com

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The federal estate tax exemption for 2024 stands at $13.61 million per individual. Federal judge rejects hunter biden’s bid to dismiss tax case in l.a.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, For 2023, the threshold is $12.92 million for individuals and $25.84 million for. Effective january 2024, the federal estate & gift tax exemption is slated to increase by $690,000, reaching $13,610,000 per person (compared to the 2023.

Source: www.harrypoint.com

Source: www.harrypoint.com

Historical Estate Tax Exemption Amounts And Tax Rates, The us internal revenue service has announced that the annual. For married couples who already maximized their.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The estate tax is often a topic of concern for those inheriting assets. Affects large estates, with the 2024 exemption at $13,610,000.

Source: www.anchin.com

Source: www.anchin.com

Estate Tax Exemption Increased for 2023 Anchin, Block & Anchin LLP, This would mean $504 for individuals, $252 for spouses, and $126 for each child. Taxpayers can opt for old or new regime.

On November 9, 2023, The Irs Released The New (2024) Federal Estate Tax Exemption Amount, Which Will Be $13,610,000.00 Per U.s.

For 2023, this limit jumps to $12.92 million for.

Effective January 2024, The Federal Estate &Amp; Gift Tax Exemption Is Slated To Increase By $690,000, Reaching $13,610,000 Per Person (Compared To The 2023.

The tax cuts and jobs act, commonly known as the “trump tax cuts,” became effective in the 2018 tax year.