Minimum Wages To File Taxes 2024. Generally, you need to file if: Citizens or permanent residents who work in the u.s.

Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024,. You probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly.

A Minor Who Earns Less Than $13,850 In 2023 Will Usually Not Owe Taxes But May Choose To File A Return To Receive A Refund Of Tax Withheld From Their Earnings.

The internal revenue service (irs) sets minimum income thresholds based on filing status and age.

If You Are Not A Dependent And You’re Under 65 Years Of Age, Then You Won’t Need To File Taxes Unless Your Income Exceeds The Following Amount:

Keep reading this article to find out if your circumstances require.

The Federal Income Tax Has Seven Tax Rates In 2024:

Images References :

Source: www.myerson.co.uk

Source: www.myerson.co.uk

New National Minimum Wage Rates Announced Myerson, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. What is the minimum income to file taxes for the 2023 tax year?

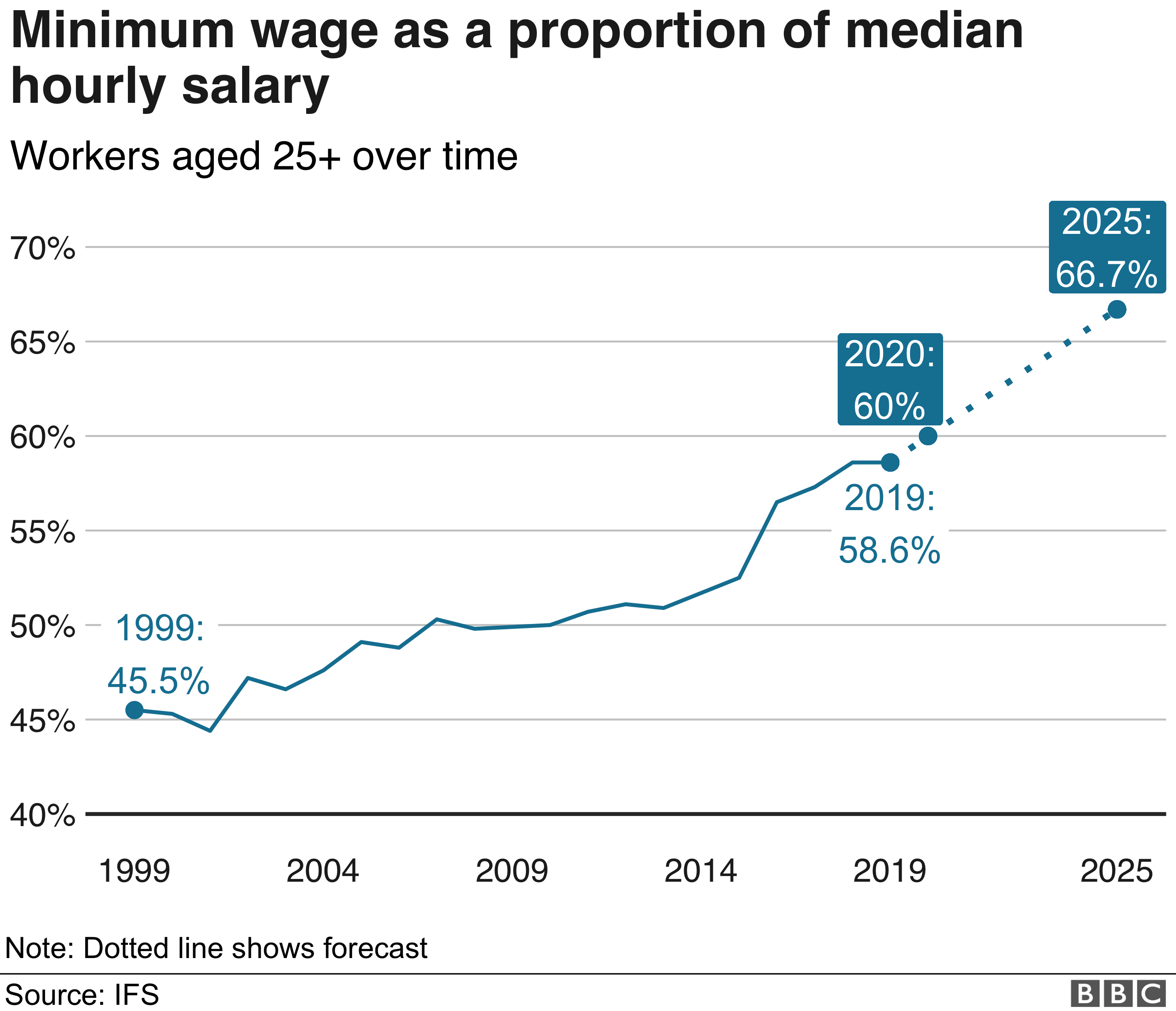

Source: www.bbc.com

Source: www.bbc.com

Minimum wage How high could the lowest salaries go? BBC News, The table below lists the current prevailing 2024 minimum wage rates for every state in the united states. The internal revenue service (irs) sets minimum income thresholds based on filing status and age.

Source: www.studypool.com

Source: www.studypool.com

SOLUTION Minimum wages regulation Studypool, The internal revenue service (irs) sets minimum income thresholds based on filing status and age. Have to file a tax return.

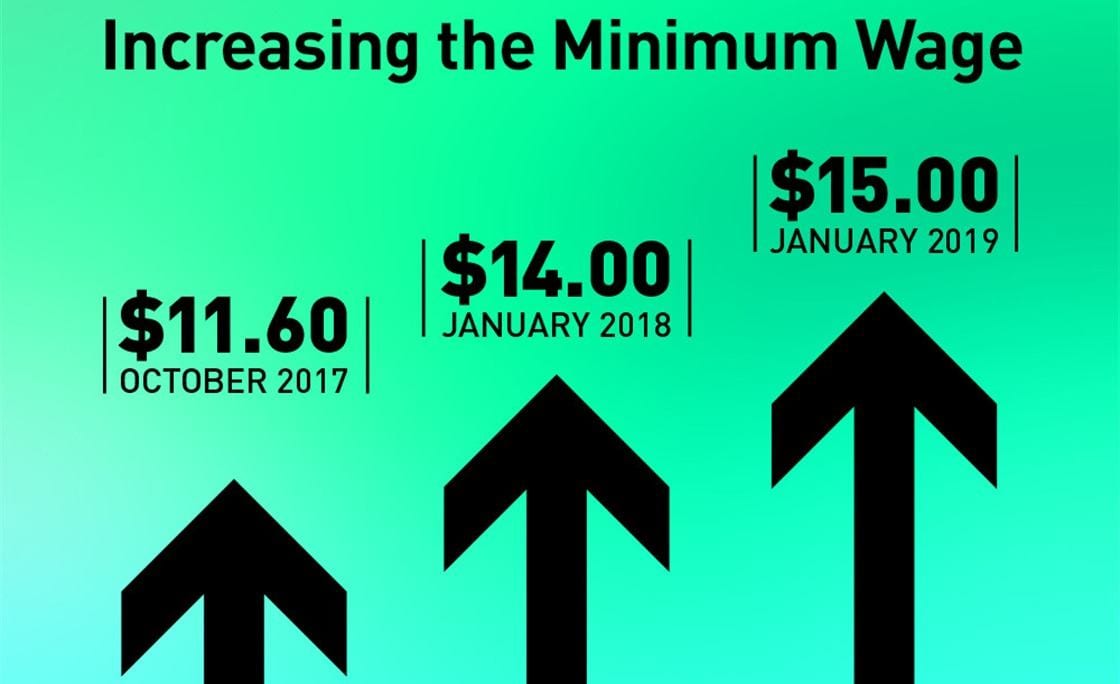

Source: sonilaw.ca

Source: sonilaw.ca

A New Minimum Wage in Ontario Soni Law, If you have two or more dependents, the credit will be up to 35% of $6,000 in expenses ($2,100). For the 2023 tax year, the minimum income required to file taxes is $13,850 for.

Source: www.studypool.com

Source: www.studypool.com

SOLUTION Minimum Wages 1 Studypool, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024,.

Source: dibyasikha.com

Source: dibyasikha.com

Latest Minimum Wages Labour Rate 2023, Odisha, The internal revenue service (irs) sets minimum income thresholds based on filing status and age. If you are not a dependent and you’re under 65 years of age, then you won’t need to file taxes unless your income exceeds the following amount:

Source: mitcagencies.com

Source: mitcagencies.com

These States are Raising Minimum Wages in 2023 MITC Agency Solutions, If you were able to take this credit in tax year 2021,. The internal revenue service (irs) sets minimum income thresholds based on filing status and age.

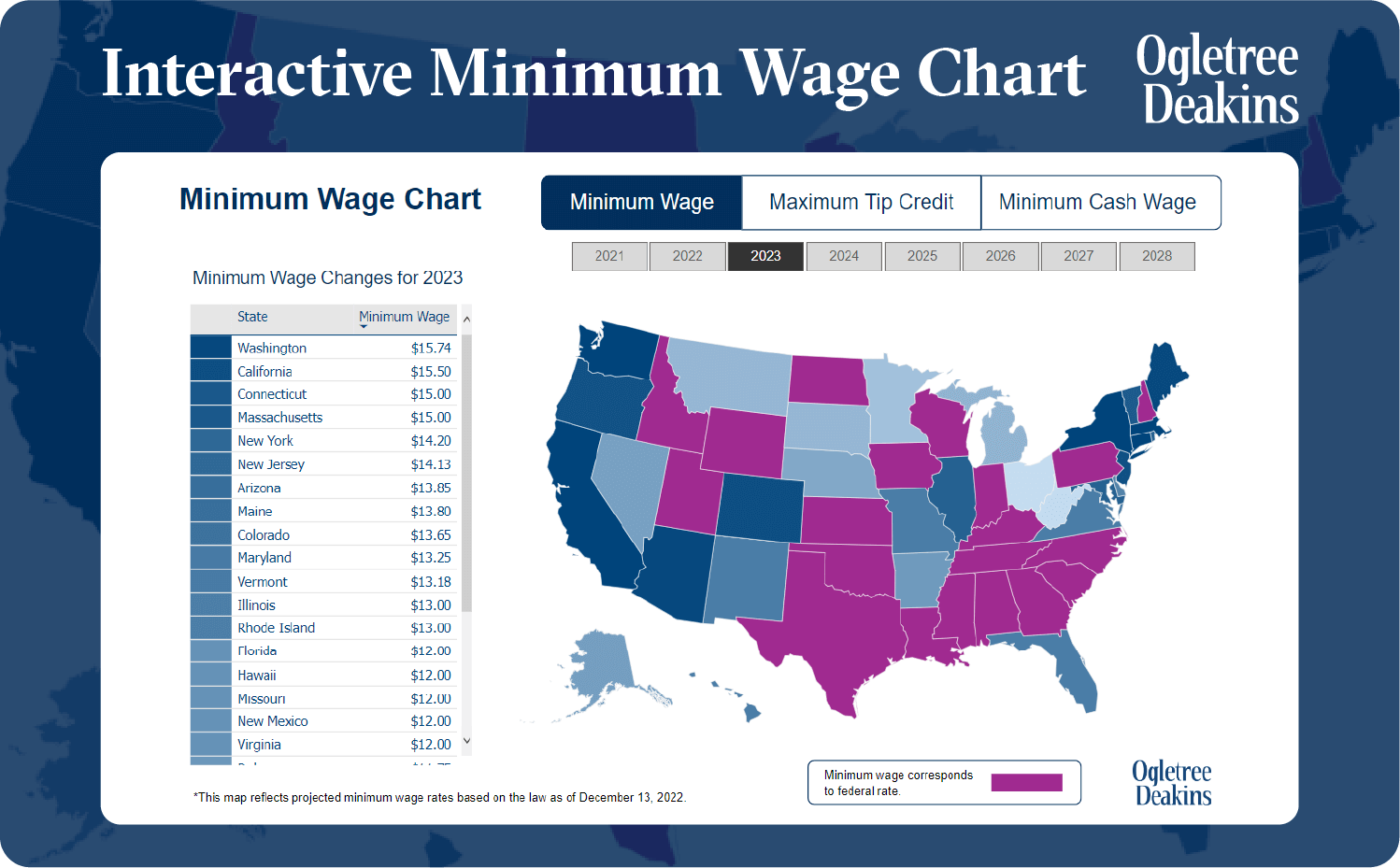

Source: ogletree.com

Source: ogletree.com

State and Major Locality Minimum Wage Updates for 2023 Ogletree Deakins, They must be paid a minimum of $2.13 per hour — known as a cash wage — in addition to tips in order to reach the federal minimum of $7.25. What is the minimum income to file taxes for the 2023 tax year?

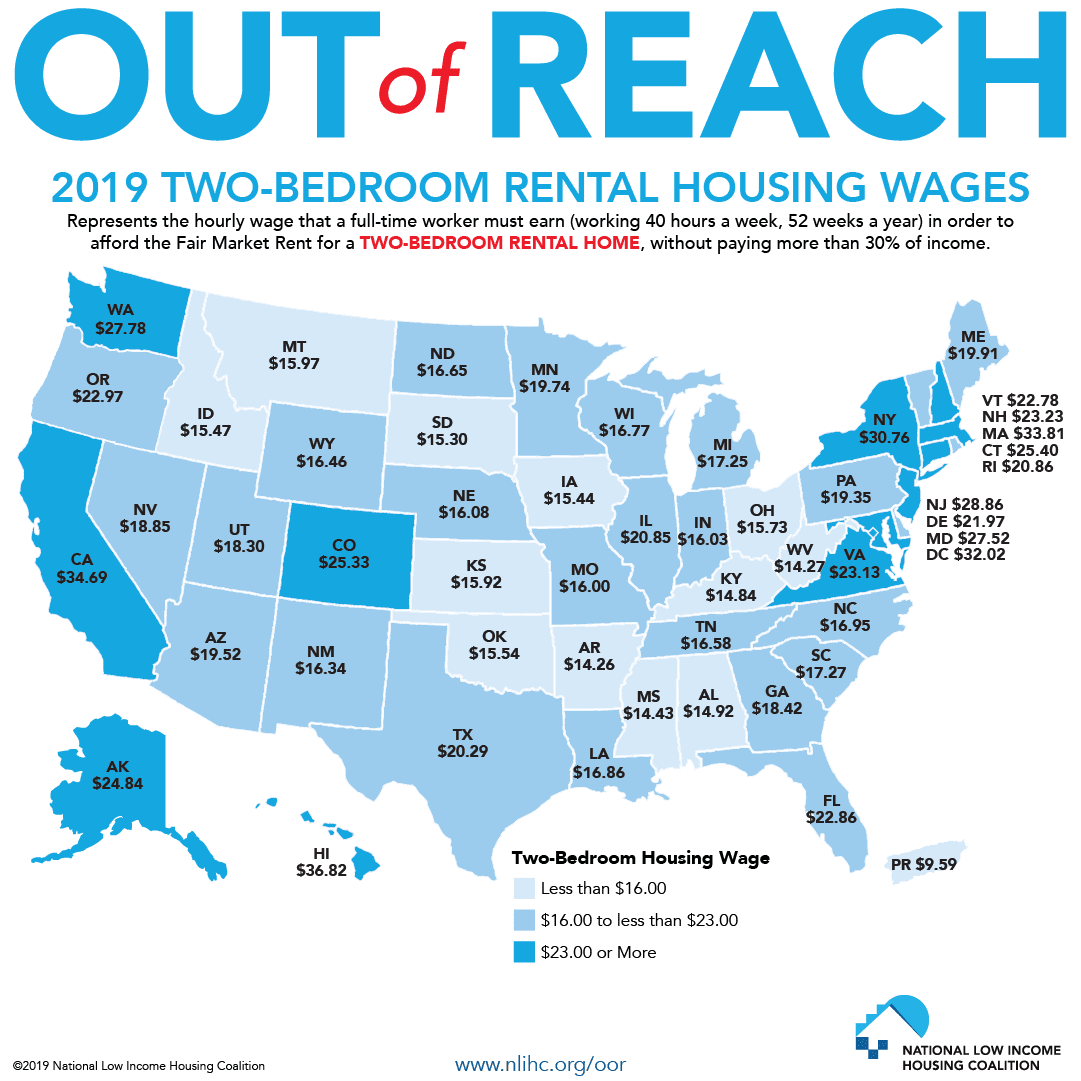

Source: www.cnbc.com

Source: www.cnbc.com

Minimum wage workers cannot afford 2bedroom rental anywhere in the US, The table below lists the current prevailing 2024 minimum wage rates for every state in the united states. For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;.

Source: docslib.org

Source: docslib.org

Minimum Wages and the RigidWage Channel of Policy1 DocsLib, 2023 tax rates for a single taxpayer. The federal income tax has seven tax rates in 2024:

The Table Below Lists The Current Prevailing 2024 Minimum Wage Rates For Every State In The United States.

Single minimum income to file taxes in 2024:

If You’re 73 Or Older, You May Need To Take Required Minimum Distributions From Your Retirement Savings Each Year.

For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;.